When some physical addition (house, garage, deck, porch, etc.) is added on the parcel, only the value of that addition is ‘uncapped’ and added to the current taxable value the following year.

(For example, a parcel purchased in 2014 will have the taxable value 'uncapped' for the 2015 tax year.)

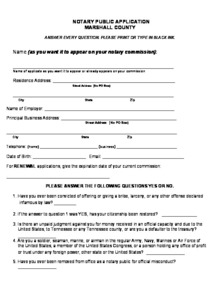

This notice will specify the time and place of the meeting of the local board of review. The assessments are placed in the assessment roll and completed by the first Monday in March for the property to be taxed.Īnnually, approximately 14 days before the first meeting of the local board of review, the assessor shall give each owner listed in the assessment roll a notice by first class mail of the increase in assessed value or tentative taxable value for the year. The township assessor shall estimate, according to his or her best information and judgment, the true cash value and assessed value of every parcel of taxable property. The township assessor is responsible for the listing and inventory of the individual properties in his or her township.

0 kommentar(er)

0 kommentar(er)